-

- GoSocial |

- MyTSU |

- AskTSU |

- Make a Gift |

- Contact Us |

- Webmail |

- Directory

- Home >

- Human Resources

- > New Hire Orientation - Flexible Benefits Plan

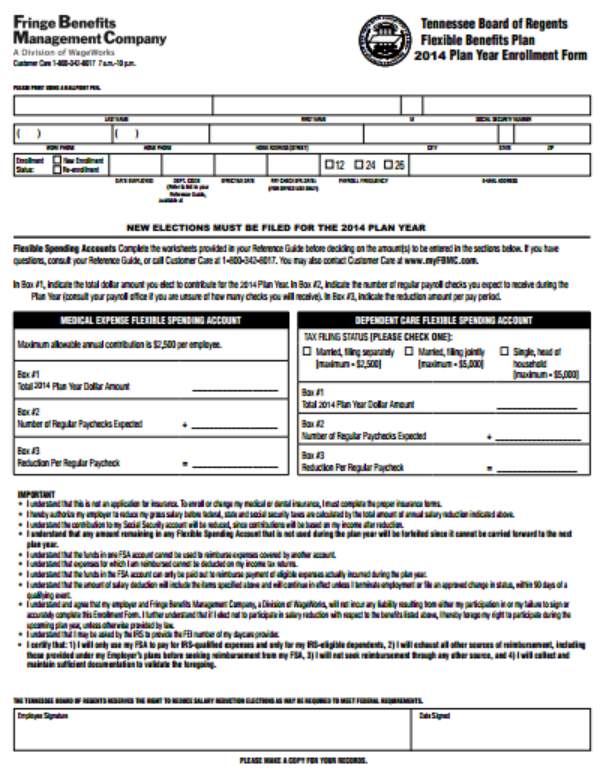

Flexible Benefits Plan

The Flexible Spending Account with FBMC allows an employee to set aside a portion of earnings to pay for qualified medical and/or dependent care (for children under the age of 13) expenses. Money deducted from an employee's pay into the Flexible Spending Account is not subject to payroll taxes, resulting in payroll tax savings. It is important to note that funds not used by the end of the calendar year (December 31st) are lost to the employee.

For more detailed information you may refer to the On-line booklet and visit the website at www.myfbmc.com.

Click here for the 2014 FBMC Enrollment Application

webpage contact:

The Office of Human Resources